Data from the Hub’s latest annual “Conquering Content” report found that 43% of respondents enjoy having so many TV shows to watch (up from 35% in 2022). The eight-point hike is the largest year-over-year increase in the data set tracking back to 2020, despite slowed production slates from the Hollywood writers’ and actors' strikes in 2023.

“We’re just starting to see broadcast series come back now,” Loughney told StreamTV Insider (STV). And while one might expect that to put a dent in perceived content abundance, the data actually “went against that notion that there was less out there because of the strikes,” He added. Some of this was thanks to “new-to-me” content, as earlier Hub research showed.

However, finding content remains a challenge, and consumers are increasingly after easier pathways, according to the survey. Sixty-one percent of respondents said they are more likely to choose a service that makes discoverability easy, increasing from 56% in 2022.

Easy content discovery is an increasingly important streaming feature for consumers (Hub Entertainment Research)

Easy content discovery is an increasingly important streaming feature for consumers (Hub Entertainment Research)Brett Sappington, founder and analyst of consulting firm Sappington Media, noted to STV that in the context of a survey, “consumers will always say they want more” for the same price, and he remains skeptical of data sets from presented questions on whether they would favor a specific improvement (discoverability) rather than an evaluation of current satisfaction levels.

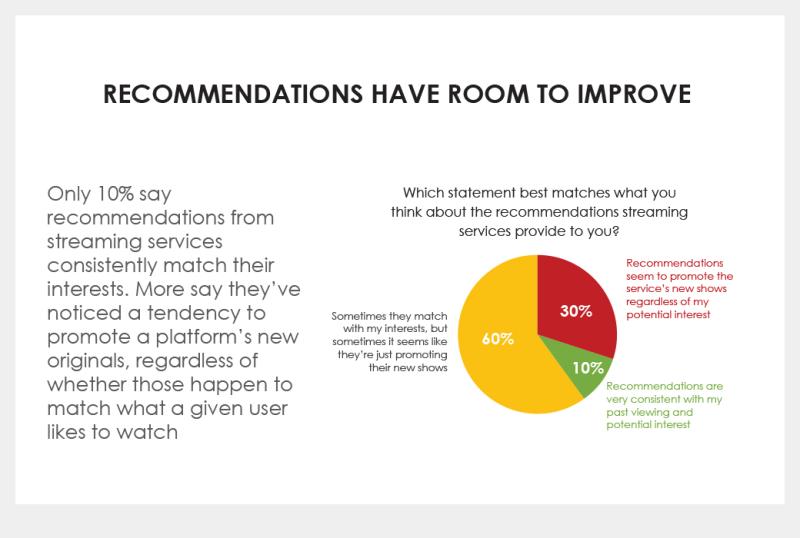

Hub’s survey did dig into consumer sentiment when it came to the relevance of streaming services’ recommendations — a feature that still comes up short. Only 10% of respondents said streaming services’ recommendations consistently match their interests. The lion's share (60%) indicated that while sometimes the recommendations match their interests, other times it just looks like a promotion of the streamers’ latest shows.

Most consumers don't feel streaming recommendations consistently match their interests (Hub Entertainment Research)

Most consumers don't feel streaming recommendations consistently match their interests (Hub Entertainment Research)“Netflix has historically promised that their algorithms are so sharp [and] surgically precise,” Loughney said, citing the way it connected data findings to launch House of Cards. “Well, they don't seem to be, as far as what the consumers think.”

He acknowledged there’s sometimes a “self-serving” quality of services' recommendations, as well as plenty of “noise” in recommendation algorithms that can come from families sharing profiles or sudden shifts in content interests (a perspective shared by Sappington). Still, Loughney warned how “quick people are to cancel if they think there’s nothing new.” That’s where surfacing library content, not just newly released or “self-serving” programming recommendations, comes into play.

The Hub consultant said, “It's so important for people to think there's still an untapped library, especially young people,” who he noted can be particularly trigger-happy in canceling subscriptions.“There's a sense, I think, that [streaming services] need to promote their prestige projects” featuring A-list actors and directors, “but from the standpoint of subscriber loyalty… it doesn’t hurt to remind people of the breadth of the libraries,” he continued.

Balancing streamer and consumer perspectives

Discoverability has always been a challenge in the industry, according to Sappington, including ever since Netflix made time-to-content (the amount of time it takes for a viewer to find and start watching content on the platform) one of its key metrics. And it continues to be a balance between two different value perspectives — streamers and consumers.

“The key issue [is] that if you pay to fund content and nobody can find it, it's wasted money for a streaming service,” he explained. “I think about how Netflix, Amazon or others that have invested millions to billions on content, some of their content from last year, you have a hard time finding this year. That's a fundamental problem.”

Consumers, meanwhile, may value content differently. “Their perspective is: One, can I find something entertaining to watch? Two, can I find what I'm looking for?” Sappington said. While algorithms continue to improve, he noted, “It's an ongoing chase to improve recommendations, to improve discovery.”

When it comes to the consumer perspective reflected in Hub’s survey findings that streamers simply masquerade new content in need of promotion as recommendations, Sappington countered that those shows often are there because of a natural spike in overall viewership.

“Say you're Netflix and you drop a new series, and you're going to put it up there because it's brand new. So suddenly, everybody watches it. Now your algorithm is saying, ‘Ooh, everybody's watching this, maybe you should watch it too’,” he explained. “Because it's new and because they're promoting it, it pushes it up in everybody's recommendations,” becoming “a cycle” that feeds into itself.

Sappington further expressed his view that discoverability within a single service is usually pretty good. “Where consumers tend to have a challenge is trying to discover across services,” he said. This becomes increasingly complex when factoring in subscription churn and the migration of licensed content across different platforms, he added, especially because “services don’t communicate with each other.”Moving into 2024, he believes content discovery across platforms will continue to be a challenge and problem over time.

“We're going to see a number of platforms and even third parties be able to help serve that [aggregated content discovery] role,” Sappington said. “If you look at Samsung TV Plus, if you look at Roku, they have a vested interest in making sure people find content across services. We're seeing increased use of those platforms for that purpose.”

Source: streamtvinsider.com