From January 2026, the TV Nova Group will increase television advertising prices by 16 per cent, which is lower than last year’s inflation rate of 22 per cent. According to TV Nova’s Sales Director, Honza Ulrych, the move is intended to ensure balanced sell-out and sufficient visibility for clients’ campaigns. Seasonal coefficients are adjusted for months with higher demand, for example, March due to the move of Easter, while footage coefficients remain unchanged. The Sales Director of TV Nova stated this in an interview for MediaGuru.cz.

The core target purchasing group of 15-54-year-olds remains unchanged. Nova will not be introducing an advertising layer to its VOD platform, Oneplay, soon, but it wants to be prepared for this possibility in the future.

Nova recommends that its clients agree on guaranteed volumes to ensure broadcasting during periods of high demand.

The introduction of out-of-home measurement (ReDAM) from January 2026 may increase available inventory by up to 10 per cent and partially offset the decline in linear GRPs.

According to Nova’s Sales Director, trading developments in 2026 will be influenced by clients’ financial results and their ability to release funds for advertising during the year. “However, I am convinced that television will remain a key part of the communication mix next year and will thus have a positive impact on demand for our inventory,” says Ulrych. He adds that Nova has seen growth in its audience share this year. “Our television group continues to significantly strengthen its share in the target purchasing group of 15–54-year-olds. In the first nine months of this year, it reached 34.1% in all-day broadcasting and 37.3% in prime time. The results confirm that our programming continues to appeal to attractive younger target groups, and I am confident that we will remain a key business partner for advertisers in the future,” he says.

Last year, you announced that despite high inflation and tight demand for advertising space, TV advertising would become more expensive again. What will the price increase be for 2026, and what is your main justification for it?

This year, we are introducing a lower level of total TV inflation of 16%. (Editor's note: Last year it was 22%.) We believe that this step will keep sell-out rates at a level that allows clients to plan their campaigns and ensures sufficient visibility for their adverts on screen.

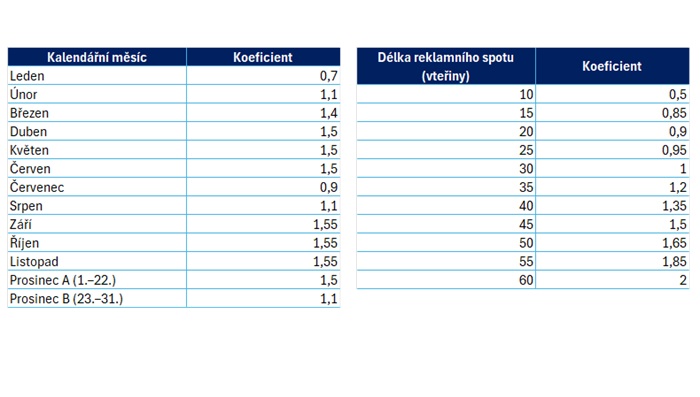

How will the seasonal and footage coefficients change for 2026, and why are these changes taking place?

In some months, the coefficients increase. This is related to events that are expected to generate higher demand. For example, the coefficient increases in March due to Easter being moved to the first week of April, which means that Easter campaigns are moved to March. The footage coefficients remain unchanged.

Given the general decline in linear GRPs, will Nova be able to offer sufficient inventory to all clients in 2026? Or do you recommend that clients agree on guaranteed volumes so they can be sure to get on the air?

We believe that our balanced pricing policy will enable us to offer sufficient inventory next year as well. It is, of course, beneficial for clients to sign up for guaranteed volumes. In the event of high demand in certain months, their campaigns will be given priority. Thanks to their decision, they can be sure that their campaign parameters will be met throughout the year.

How would you describe the overall development of the advertising market in recent months?

This year, we are seeing a decline in demand from international clients, and we expect market growth to be weaker than in 2024. We are compensating for this decline in demand by increasing sales of advertising space to smaller clients and offering additional advertising formats on our TV channels.

What do you see as the main factors influencing television advertising in 2026?

It will depend greatly on our clients’ economic performance and their ability to release additional funds for advertising during the year. However, I am convinced that TV media will remain a key part of the communication mix next year and will thus have a positive impact on demand for our inventory.

Are you considering adjusting your target audience due to demographic changes and trends in linear viewing? Will Nova remain at 15–54, or are you considering shifting your target audience?

We will not be changing our purchasing target group next year. It is attractive to clients, and we still offer sufficient inventory in this target group on the market.

Are you planning to respond to the growing role of the AVOD model? Are you considering introducing an advertising layer for Oneplay in 2026, or other forms of monetisation?

We recognise the growing importance of the AVOD model and are considering its potential role within Oneplay. However, we are not directly addressing this at the moment, and it is not on the agenda. We are focusing on the technical and data parameters of the service so that we are prepared to respond to any future opportunities.

And when it comes to monetising advertising in IPTV catch-up viewing, is restricting ad skipping in catch-up viewing a direction Nova could take next year to offset the decline in linear GRPs?

With the launch of out-of-home TV audience measurement, known as ReDAMod, in January next year, the volume of available advertising space will increase. According to preliminary calculations, this could be an increase of up to 10%. By expanding measurement, we will thus partially eliminate the possible decline in existing inventory. We are considering a ban on ad skipping, but it is not yet clear whether or when we will implement it.

Are you noticing changes in client demand – for example, is there growing interest in HbbTV, sponsorship or product placement at the expense of traditional adverts? How is the business policy for 2026 adapting to this?

For our clients, these products are a welcome addition to the forms of communication on our television, and we can see this in the overall growth in volumes. We expect interest to continue next year. The commercial policy of supporting other media channels remains the same for 2026.

In the pay-TV segment, the range of sports channels will be expanded to include Oneplay Sport and Premier Sport. How will they be integrated into TV Nova’s sports channel trading?

From 1 December 2025, TV Nova will become the 100% owner of O2 TV. This means that the Oneplay Sport and Premier Sport channels operated by O2 TV will be transferred directly to Nova. After this date, we will inform clients how they will be integrated into TV Nova’s sports channel trading.

And how will prices on Nova’s paid sports channels change next year?

Advertising price increases vary depending on the type of advertising format and client demand. For example, for some Formula 1 formats, the increase can be in the tens of per cent. Among the most sought-after are special advertising formats, such as split-screen spots in F1. Clients also often prefer sponsorship of our main competitions or advertising integrated within product placement.

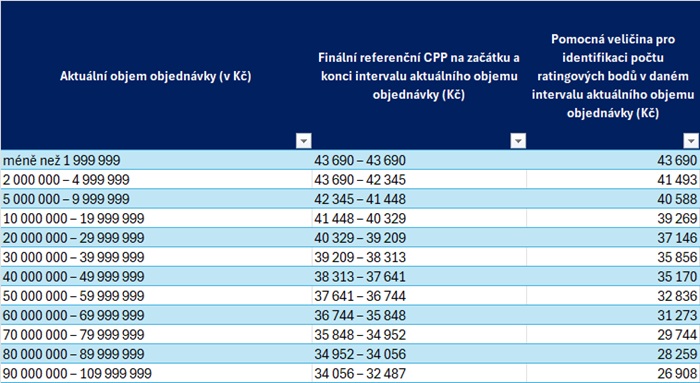

Pricing conditions on Nova Group's measured TV channels for 2026; Source: TV Nova

Pricing conditions on Nova Group's measured TV channels for 2026; Source: TV Nova TV Nova's footage and seasonal coefficients for 2026; Source: TV Nova

TV Nova's footage and seasonal coefficients for 2026; Source: TV NovaHonza Ulrych, Sales Director, TV Nova

He has been the Sales Director of TV Nova since early 2023, overseeing all sales teams focused on GRP, contextual and digital sales. His responsibilities include defining commercial policy strategies and further strengthening Nova Group’s position in the advertising market. He joined TV Nova’s sales department in 2006.

Source: mediaguru.cz