The year 2024 brought moderate but stable growth to the Czech advertising market. Investments in marketing communications exceeded CZK 150 billion, with television and online media maintaining their dominant position. Despite a global growth rate of 7%, the Czech market showed only a 3% year-on-year increase. We present the main conclusions of the 2024 advertising report, prepared by the Association of Communication Agencies (AKA) and the Association of Media Agencies (ASMEA), compiled by ResSOLUTION Group.

While global advertising spending grew by 7% to reach USD 1.87 trillion (Statista.com), the Czech market is lagging slightly behind. The US remains the world's largest player, with investments of over USD 422 billion. Digital media accounts for 73% of global spending and is expected to grow to 78% by 2028.

The Czech Republic is following trends with a delay, and the market as a whole is therefore growing more slowly. Here, too, television and online media dominate.

The Czech advertising market in 2024 is stable but cautious

The Czech advertising market climbed to CZK 150.2 billion in 2024, representing year-on-year growth of 3.3%. The pace of growth has thus slowed compared to previous years, as the market grew by 12% between 2022 and 2023, for example. Nevertheless, the mood on the market remains optimistic and the market can be assessed as stable. A more favorable forecast and an acceleration of growth to 6.8% are expected for 2025.

"2024 did not meet the expectations that the marketing market had placed on it at the end of 2023. Investments slowed down and their growth stabilized at single-digit values. The market is currently showing caution and seeking stability," says Lucie Vlčková, Head of Insights & Media Research at Nielsen/ResSOLUTION Group. This is mainly due to economic uncertainty, stagnating purchasing power, and the need to stabilize budgets after the pandemic.

Non-media channels are gaining momentum

In 2024, there was a gradual recovery in investment in non-media channels (events, loyalty programs, direct communication). These so-called activation forms of marketing are expected to grow by 3.8% year-on-year, representing approximately CZK 2.1 billion. "Despite the slowdown in marketing investment growth, optimism remains among advertisers, indicating a gradual recovery in confidence in budgets and strategies," adds Ondřej Gottwald, chairman of the AKA activation agencies section and CEO of the agency Garp Integrated.

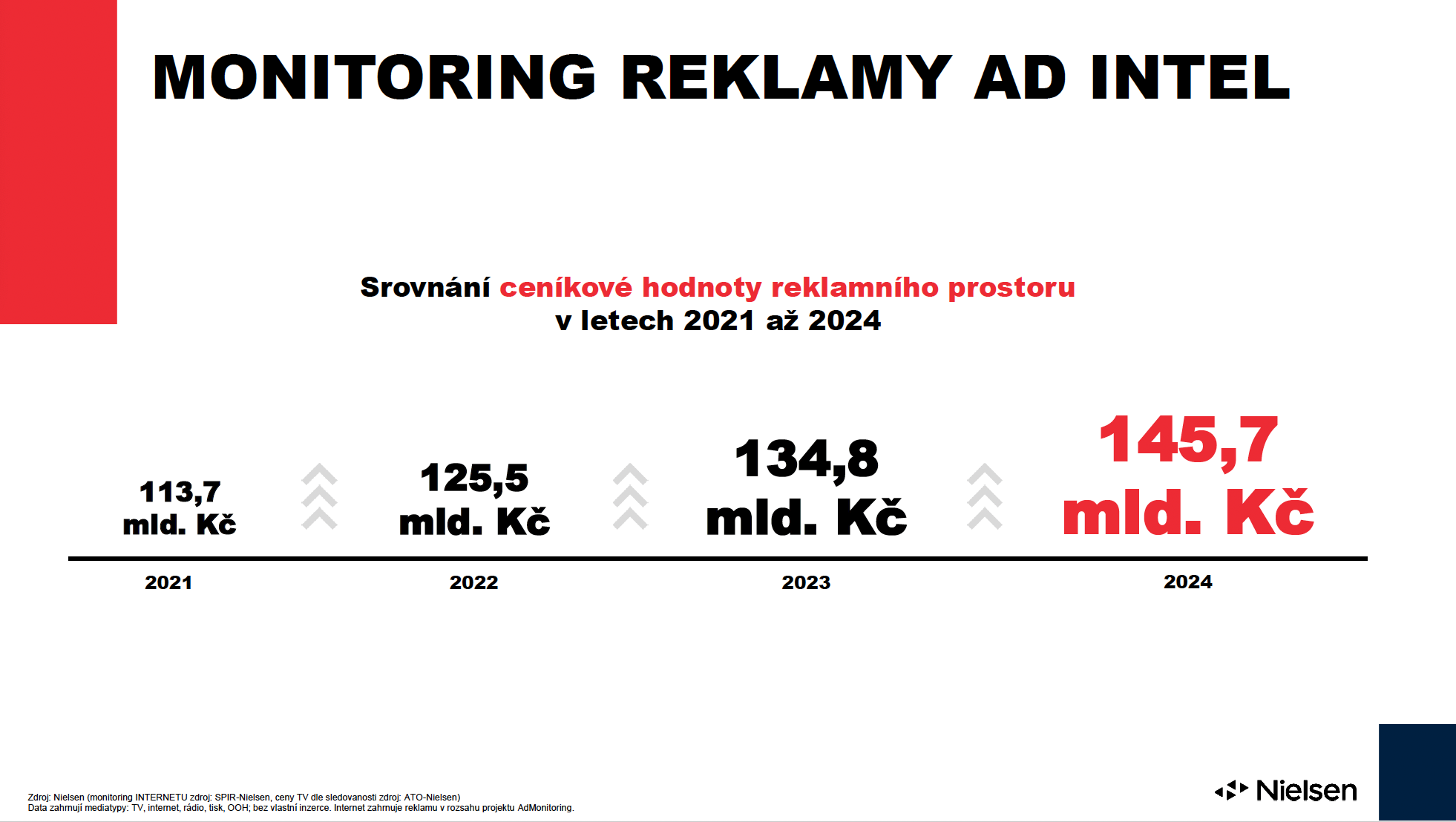

List prices for advertising are influenced by growing market pressure and space prices

The year 2024 confirmed that the Czech media market has stabilized, but at the same time continues to face growing pressure on the availability and price of advertising space. List prices across all media rose, with television and the internet continuing to dominate. Television advertising experienced not only increased interest but also a dramatic shortage of space, which led to TV inflation exceeding normal market inflation.

Across all media types, a total of CZK 145.7 billion was spent in 2024 according to list prices, compared to CZK 134.8 billion in 2023. This represents an increase of more than 8%, reflecting not only a larger volume of campaigns but also an increase in unit prices across segments. Digital channels recorded the strongest growth, followed by television and radio. Print media stagnated, while outdoor advertising grew only slightly.

However, this growth cannot be attributed solely to advertisers' greater willingness to spend – demand significantly exceeds supply, especially in the television space. The result is a widening gap between rising price lists and limited capacity for campaign deployment. According to experts, this phenomenon may put pressure on new methods of planning and cost optimization in the future.

Food chains, e-shops, and pharmacies are the biggest advertisers

Traditional players such as Lidl, Albert, and Kaufland were once again among the top 10 advertisers in 2024. An interesting development was the rapid rise of Allegro, which increased its investment by 79% and entered the top ten largest advertisers. Food, banking, pharmaceuticals, and electronics categorically dominate.

Personalities in advertising: Ivan Trojan "defeated" by Hynek Čermák

The year 2024 also brought change in the field of celebrities in advertising. After years of dominance by Ivan Trojan, a new face appeared – Hynek Čermák, whose commercial for Staropramen became the most popular. Alzák reigned supreme among mascots in terms of spending, with a budget of over CZK 1.3 billion, but not in terms of popularity. "The ideal actor in advertising? He listens to every word, never ages or misbehaves, is always on set and doesn't want much money! That's probably the dream of all advertisers who have chosen CGI replacements over live actors. Research into personalities in advertising confirms the extraordinary rise of viral actors. Will Ivan Trojan also be virtual one day?..." asks Pavel Brabec, president of AČRA, provocatively.

Marketing and artificial intelligence

The trend of the year was the integration of artificial intelligence, especially for content personalization and more efficient data management, campaign preparation, content creation, and better targeting. At the same time, however, brands are facing pressure to be authentic and human. "Customers want natural, value-oriented content. The balance between technology and humanity will be decisive," says Kateřina Hrubešová, director of AKA.

Hourly rates in marketing: Agencies want fair compensation for their work

A survey of marketing professionals' hourly rates shows that year-on-year wage growth was only 4.2% in 2024, which is less than the official inflation rate in the service sector (5.01%). The marketing sector is therefore losing out in real terms, as it is unable to keep pace with inflation due to increasing client demands and rising input prices.

Petra Jankovičová, president of AKA, comments: "Communication agencies are facing increasing demands for performance, but without adequate financial rewards. But unrealistically low prices and high expectations are dangerous not only for agencies. Ultimately, they also threaten the clients themselves, as they are reflected in the quality of outputs and the actual results of campaigns. And if campaigns fail to meet their objectives, there are no savings in reality – quite the contrary."

The result is demotivated employees, pressure to increase efficiency, and, in the worst case, compromises in quality. Long-term underfunding can lead to a loss of talent and a reduction in the innovative potential of agencies. While the role of marketing in the economy is growing (its share of GDP has risen significantly), its price valuation remains inadequate.

You can find more about hourly rates here.

State communication budget down 6%

The public sector remains a weak link. Despite politicians' declarations, state institutions' spending on communication fell by almost 6%, representing a drop of CZK 175 million. The Association of Communication Agencies has long pointed out that citizens' trust can only be strengthened through systematic and open communication.

Inflation is rising, but not everyone is getting the same value

The current situation confirms that the advertising market is not evenly balanced. Advertising space prices are rising faster than the salaries of those who fill that space with content and strategy. While media houses and digital platforms are benefiting from growing demand, communication agencies and their teams are often struggling with underfunding.

The debate on fair remuneration in the advertising business needs to be reopened. Among other things, experts recommend wider use of Value Based Pricing (pricing based on value rather than time), which better reflects the real benefit of a campaign for the client.

The year 2024 confirmed the trend towards digitalization, an emphasis on personalization, and data-driven strategies. The advertising market is looking for stability, with an increasing focus on efficiency and value for money. According to predictions, 2025 will bring a slight recovery—provided that companies and the government show greater confidence in the power of communication.

The research methodology and the full press release are available for download HERE.

The full Advertising Report 2024 can be downloaded here or in the Downloads section HERE.

Source: aka.cz