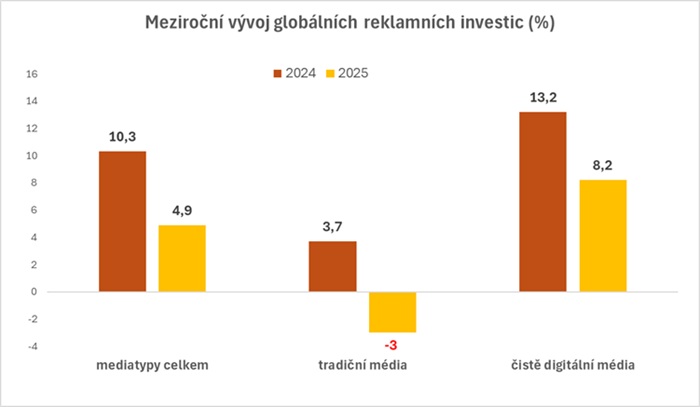

Globally, the media market is maintaining stable growth in terms of investment in advertising space, but the updated outlook shows that the growth rate will flatten in 2025. Compared to 2024, 2025 is expected to see a 4.9% increase, half the rate of the previous year. Adjusted for the absence of the US election and the Olympics last year, the slowdown in growth is more modest, from 9% in 2024 to 6.2% in 2025. The data is based on market research by Magna, which estimates net advertising revenue for media owners based on analysis of financial reports, advertising tracking and data from local organisations and agencies.

Significant differences are evident between different media types or mediahouses. Traditional media operators are most affected by the absence of major events, economic uncertainty and expect a decline of more than 3%. TV advertising revenues are expected to fall by 5%, radioby 1% and print by 6%, while outdoor advertising (OOH) and cinemas are expected to grow by around 5%. These figures include non-linear advertising, typically online publisher revenues and digital TV content, which already account for 25% of total advertising revenues of traditional media houses globally and are growing at 15-30% annually, mitigating the decline of linear advertising formats.

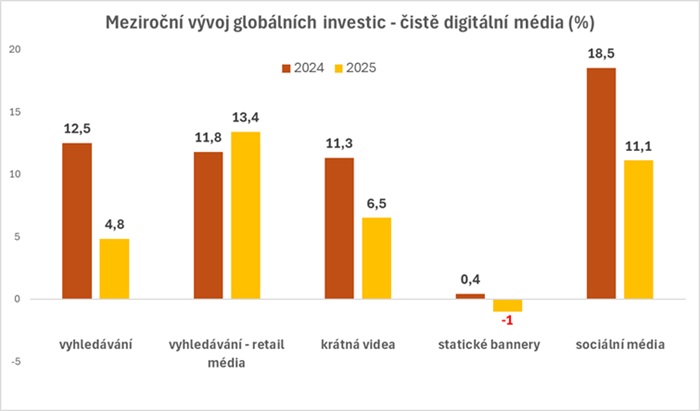

As a result,pure digital players are contributing to overall market growth, with a projected growth of around 8%, driven primarily by the growing use of online, innovations in artificial intelligence, competition in e-commerce and retail media networks. Globally, this already accounts for nearly three-quarters of advertising revenues. Proportional differences are also evident here, with search and retail media advertising (e.g. Google, Amazon, Walmart) growing by 8% and remaining the largest pure online segment in terms of volume. Revenue from social media advertising (Meta, TikTok) will grow by 11%, while the short video category (YouTube, Twitch) is expected to grow by 7%.

Estimated Global Media Advertising Investment Trends, Global Media Landscape, June 2025; Source: Magna

Estimated Global Media Advertising Investment Trends, Global Media Landscape, June 2025; Source: Magna Estimated Evolution of Advertising Investment in Traditional Media, Source: Global Media Landscape, June 2025; Source: Magna

Estimated Evolution of Advertising Investment in Traditional Media, Source: Global Media Landscape, June 2025; Source: Magna Estimated evolution of global advertising investment in different digital channels, source: Global Media Landscape, June 2025; Source: Magna

Estimated evolution of global advertising investment in different digital channels, source: Global Media Landscape, June 2025; Source: MagnaThe increase in online usage is the result of long-term organic growth factors such as the expansion of e-commerce and retail media networks, emerging markets or new regional opportunities. In times of uncertainty, it also reflects a greater focus on performance tactics and lower funnel activities, which are expected to be more elastic and measurable in driving short-term sales.

A separate chapter is streaming ad-enabled services, which continue to see rapid growth in reach, time spent and ad sales. Most global players offer more affordable ad-supported tariffs that are preferred by new users, and existing ones often switch to them. As a result, advertising on premium CTV services already accounts for 15% of global long-form video advertising revenues worldwide, and up to a quarter in mature markets.

The outlook for 2026 is more positive. The global advertising market will accelerate again as the economy is likely to stabilise and major events return, including the Winter Olympics, FIFA World Cup, US congressional elections, etc. Global advertising revenues are expected to grow at over 6% and exceed the one trillion dollar mark for the first time.

Pavel Koreň, Research & Insight Director, Mediabrands

Source: mediaguru.cz