In the first part we showed you that Czechs 45+ are the richest Czech target group, which doesn't make much sense to neglect, but that at the same time it is not a homogeneous mass. Today, we'll continue with another barrage of data to show you that the consumption behaviour of Czechs 45+ is not that different from those younger (25-44). So it's hard to justify not targeting these Czechs because they have succumbed to mass asceticism. In fact, communications aimed at younger target groups are quite likely to reach them, but rarely do they. So you leave their purchasing decisions to chance. Instead of going for it.

Visiting the Czechs 45+

It would seem from the advertisements for durable goods that people buy washing machines, refrigerators, dishwashers or even shavers until the middle of their fifth decade of life at the most, and then there is a turning point.

However, given the usual (un)lifespan of various electrical and electronic gadgets, it is surprising that brand communication does not try to target Czechs aged 45-64. They have finances, they want comfort and, frankly, after the phase of small and teenage children, every household is usually ripe for renovation - appliances not excluded.

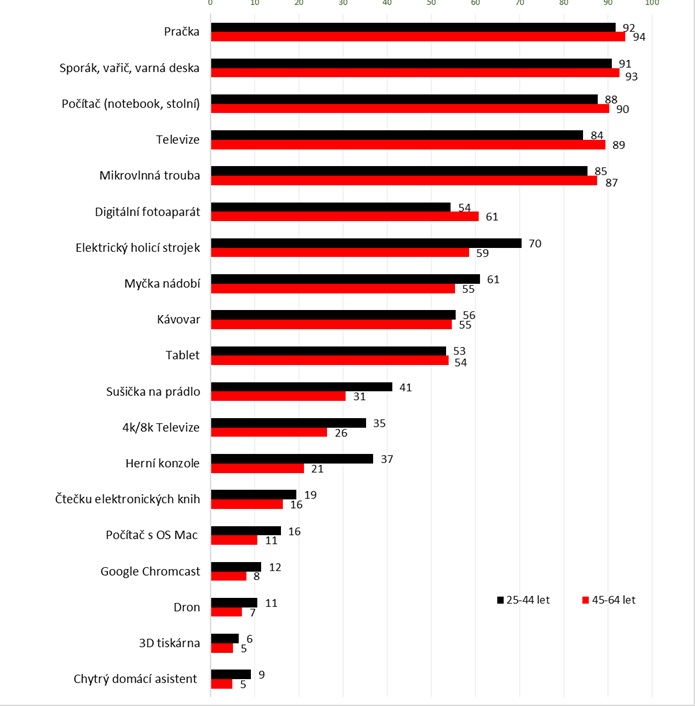

Moreover, from hard data, it does not seem that the households of mature Czechs are fundamentally different from those of younger people. Washing machines, cookers, computers, televisions or microwaves are even more common than among the younger 25-44 year olds (although the differences are not large). Even coffee machines and tablets are found in the same numbers in both subgroups.

The first major difference is in digital cameras, which are more often owned by Czech households 45+. In contrast, electric shavers, clothes dryers, high-definition TVs or games consoles are more often found among younger Czechs. The difference is largest for consoles (younger people lead 2:1). For electric shavers, we can only speculate on the reasons (perhaps marketing works better on younger people, or more mature men are not so keen to change their habits).

By contrast, for clothes dryers, more modern TVs and games consoles , the explanation is quite simple and related to life stages. Nowadays, it's more the norm to have a clothes dryer (especially with young children). With newer TVs, it's clear that when you buy something for the first time, you usually buy the latest (young couples and/or first independent living, etc). And with consoles it's even clearer - after all, the younger ones play more (although don't underestimate the 45+ generation here either).

Plus, there's no difference at all between the two groups in their plans to renew various home appliances. So why not reach out to them?

What they have at home (% of households equipped with the appliance)

Source: mPanel, WPP Media data source

Source: mPanel, WPP Media data sourceSmart Home

The trend these days is for various smart products in the home - after all, it doesn't hurt to have at least someone smart in the household. In this respect, it is no use hiding the fact that mature Czechs are a bit behind the younger ones. While 39% of Czechs aged 25-44 have some element of a smart home, 27% of Czechs aged 45-64 have some element of a smart home. Both life stage factors may play a role (getting the first equipment = usually more modern) and it's quite possible that some more mature Czechs don't feel the need to have a vacuum cleaner at home.

The truth is probably somewhere in the middle, given that what makes the biggest differences between the two groups of Czechs are smart TVs, washing machines and on the other hand robotic vacuum cleaners or lighting. So not some extra special devices.

Food

After consumer durables, we logically move on to FMCG. Do not expect a detailed list of all categories. Our aim is mainly to show by examples that even Czechs aged 45-64 usually buy and consume the same as younger people (i.e. 25-44).

We start with food. It may surprise some, but mature Czechs buy food as often as younger ones, and even in the same places.

You will find few food categories where Czechs aged 45-64 are any different from younger ones aged 25-44. For example, mature Czechs consume more coffee and tea, while those aged 25-44 drink a bit more energy drinks and sodas.

But most of the differences can be explained by natural changes in life stages - which is the case for all foods related to children (especially young ones). Where there is an attitudinal difference, however, is in the various plant-based meat substitutes and soya products, which are much less popular among the older Czechs.

When it comes to food shopping (or, more precisely, shopping in chains that sell food) , Czechs aged 45-64 are more demanding shoppers than younger ones. Freshness of food, accessible location, sufficient opening hours or a wide range of goods are what everyone wants, regardless of age. However, more mature Czechs are more likely to want parking (46% vs. 39% for 25-44 year olds) and are also more likely to want helpful staff. Conversely (at least declaratively), they are relatively less likely to look for special offers (35% vs. 45% for younger Czechs).

Cosmetics and body care

You already learned in the first episode that 45+ Czechs do not neglect taking care of themselves. The fact that from a certain age onwards it simply takes a bit more work and effort to look good, and various cosmetic patches and ointments simply come in handy.

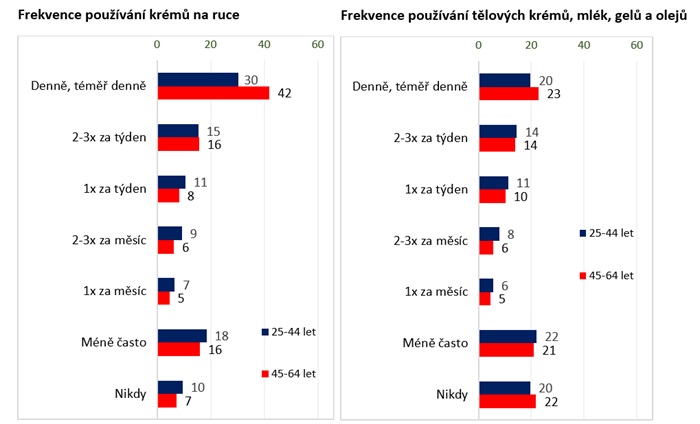

The use of creams and body lotions, for example, corresponds to this. From a certain age onwards, those who apply the ointment mature - the others grow old.

Frequency of use of hand creams

Source: mPanel, data source WPP Media

Source: mPanel, data source WPP MediaBut you'd find a similar trend in most cosmetic categories - with one exception, and that's products for problem skin. This is a problem that most mature Czechs are relieved to have put behind them.

Clothing, footwear and fashion

When we cater for the face and skin, we need to cover it with something (at least sometimes and partially). Although it doesn't seem like it from most clothing and shoe advertisements (honour the exceptions), even Czechs aged 45-64 don't go naked, barefoot or in 20-year-old rags and scrubs.

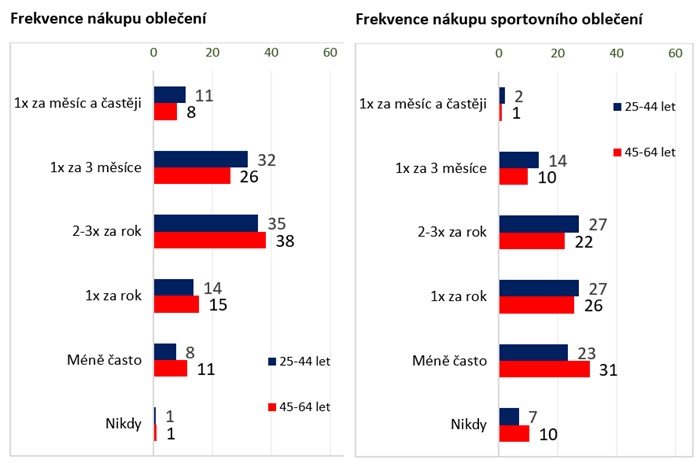

As you can see from the data examples above, Czechs aged 45-64 are not that far behind younger people when it comes to shopping for clothes. The slightly higher frequency of casual clothing purchases by Czechs aged 25-44 is largely influenced by the provision of children and a slightly higher tendency to follow fashion trends. For sportswear, apart from the children factor, it is also the lower frequency of exercise and actual sports activities for the 45+ generation. On the other hand, given the numerical strength of this group of Czechs, these are still interesting volumes of goods.

And, by the way, the differences in shoes are significantly smaller. In footwear, mature Czechs simply do not limit themselves in any way, and sports shoes are popular in the Czech Republic regardless of age.

Source: mPanel, data source WPP Media

Source: mPanel, data source WPP MediaOnline shopping

At least once a month, 70% of our Czechs aged 25-44 and 55% of our Czechs aged 45-64 shop online (we're showing the data a year behind, so it's a bit more than that again).

The lagging behind of Czechs 45+ in online shopping compared to younger ones is due to two other important factors. Firstly, there is no longer a need to shop so frequently because of children and secondly, there are really very big differences between the different segments in this case. While 70% of people in the Active and Discovering segment, which is the youngest segment in terms of attitude and mentality, shop online weekly, only 45% of people in the Cool and Easy segment, the oldest in terms of age and mentality, do so.

Differences in the use of online shopping between the two age sub-groups are also influenced by the frequency of purchases in different categories (both online and offline). For groceries, cosmetics, perfumes, over-the-counter medicines or all sorts of electronics and electrical appliances, the differences are essentially undetectable. But there are categories where more mature Czechs lag behind. Czechs aged 45-64 are slightly less likely to buy fashion accessories, jewellery and watches, mobile phone accessories, software and computer games or tickets to events.

On the other hand, this group of Czechs has the advantage that it will still be the largest group in the foreseeable future, so it is still interesting volumes, whether off or online.

And in the last episode we will look at where and how to reach them.

Petr Tomas, Consumer Research Skillhead, WPP Media

Source: mediaguru.cz