Representatives from RTL AdConnect and smartclip presented their exclusive “New Life of the Living Room” research on European media consumption and consumption habits in a live online broadcast. The study was carried out earlier this year in 10 European markets and is intended to serve advertisers, media agencies and broadcasters to make the best possible decisions on the distribution and optimisation of advertising investments based on media consumption behaviour.

THE CONTENT CONSUMPTION REVOLUTION

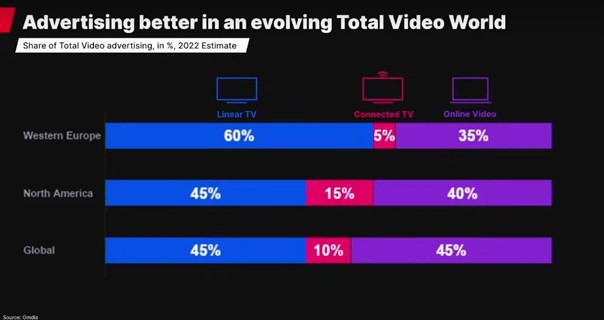

In recent years, circumstances have significantly changed the way, when and where people watch video content, which naturally affects the way they consume advertising. One of the major changes taking place in the media world is the redistribution of advertising, with the share of advertising gradually levelling out in linear broadcast and online. While in Western Europe advertising still dominates in linear broadcasting in 2022 (65% linear TV, 35% online), in North America the two distribution channels are almost equal (45% linear broadcast, 40% online), and the same is true globally. At the same time, we are also seeing growth in the amount of advertising served in the Connected TV environment.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

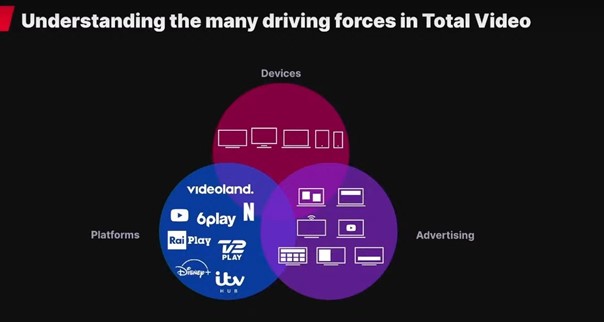

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”So it's important to understand how potential customers interact with their devices - TV screen, mobile, gaming console and more, what content they're looking at and what advertising they're watching. All of us have the opportunity to watch much more content today than our grandparents did. It's also a new opportunity for advertisers to reach and engage with the new platforms that consumers are using. Content distribution is so much more fragmented, while at the same time bringing a host of new opportunities. All these changes and new trends then accelerated even more during the coronavirus pandemic.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”For those conducting the research, then, it was crucial to find a way to put these puzzles - devices, content and advertising - together in the best possible way, as the behaviour of content consumers is what drives changes in the media industry forward.

HOME HAS BECOME OUR PRIORITY

In 2020, a coronavirus pandemic hit the world and completely changed our lives - sending us into isolation, quarantines and work-from-home situations. "Among other things, this has made us take more care of our homes - 32.7 percent of European household spending went on new furniture and home furnishings," recalls Daniel of smartclip. The home has thus once again become the centre of family life, with the living room at its heart. "And that's also why we say we want to get a closer insight into living rooms. Because if you ask consumers what the living room means to them, you'll find that it's a safe environment, used for relaxation as well as relaxation. It is therefore a very good place for advertising to reach them, an opportunity to catch them in a good mood and open to new stimuli," adds Daniel.

Across European countries, then, we see two trends in how living rooms are furnished and organised. The first one is the so-called family sanctuary, i.e. the common centre of life, especially in the case of households with children, where all family life takes place. In the second case, the living room has become a second office, especially for younger people who spend their working day here.

WHAT DO WE DO MOST OFTEN AT HOME?

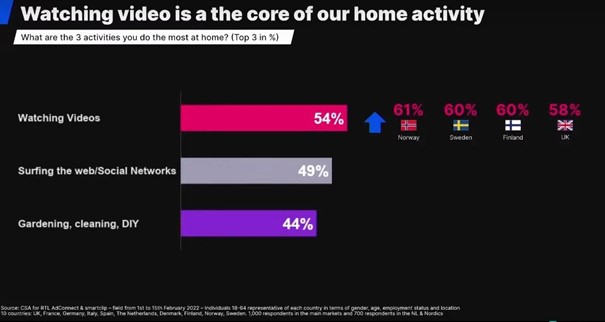

The study thus provides a holistic view of how people's behaviour and media consumption in living rooms has changed for consumers across Europe. Before getting to the focus on the living room itself, the research also looked at the overall activities people engage in at home. Watching videos was the most common home activity (54%), followed by surfing the internet (49%) and gardening and housework (44%). In countries such as the UK, Norway, Finland and Sweden, even more than 60% of households ranked this activity first. Interestingly, in Germany, watching videos was only fourth and dominated by housework and gardening. Despite these differences, watching videos is already an important part of our lives.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

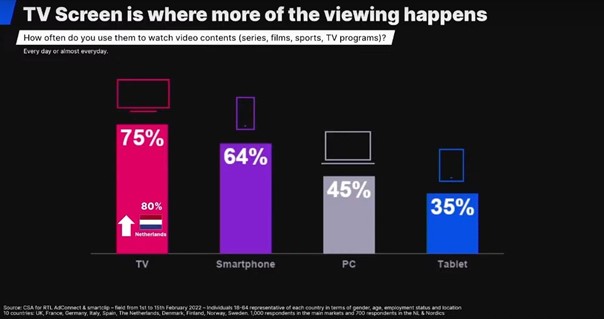

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”People are then most likely to watch video on a large TV screen (75%), followed by a smartphone (64%), PC (45%) and tablet (35%).

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

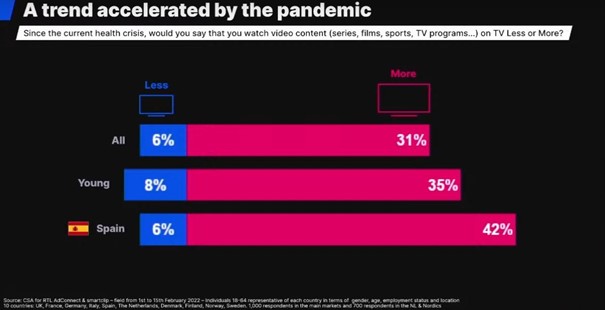

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”TV thus remains the most important point of connection between consumers and advertisers with their brands. There were even comments in the research such as "the TV is on all the time I'm in the living room." This trend was then further accelerated by the coronavirus pandemic, when people were even more engaged in watching videos than in the period before it, right on the big screen.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”Almost the majority of European households are equipped with a television. 92% of Europeans have a TV at home, 71% own a Smart TV device and 55% bought a new Smart TV in the last two years, during the coronavirus pandemic. For younger target groups, the figure was as high as 65%.

Almost 40% of users then expect a new screen to be even bigger than the previous one when they buy it. This means that even the delivery of the advertising message can be bigger and bigger, while more and more programmes are being watched in higher quality resolution than the standard. Last but not least, screen enlargement also means that consumers want increasingly smarter TVs with internet connectivity, more content and more experiences.

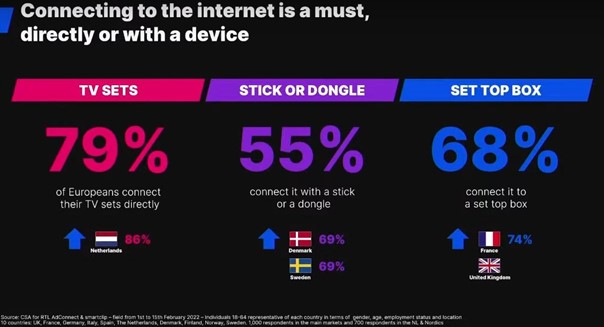

Almost 80 percent of Europeans have a TV connected to the internet, so it is possible to reach them with digital advertising even on the big screen. Also, some types of set-top boxes, provided mainly by telecom operators such as Telenor, allow TV to be connected to the internet.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”This suggests that viewers' living rooms are full of opportunities and challenges to reach people with advertising messages. There are more devices where consumers can be reached with advertising, their impact has grown as big screens have become larger and more feature-rich, and the ability to share digital advertising on them has grown.

ONE SCREEN, BUT LOTS OF OPTIONS

So what are the specific opportunities and possibilities to reach consumers with advertising in the new, changing media landscape? This was the topic for Sebastian from RTL AdConnect, a company that specialises in selling advertising space in the European market.

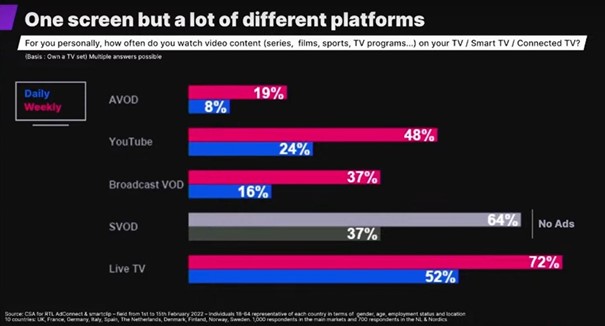

One of the challenges, and a new opportunity, that Sebastian picked up on is audience fragmentation and the use of different platforms. Viewers no longer just watch linear TV programming on big screens, but also content from pay video services and other online players like YouTube.

The research shows that linear TV still retains a significant role on the big screen, with more than half of the survey respondents watching its programming on a daily basis. This provides viewers with a great deal of choice and a challenge for broadcasters and advertisers to reach consumers on these different platforms.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

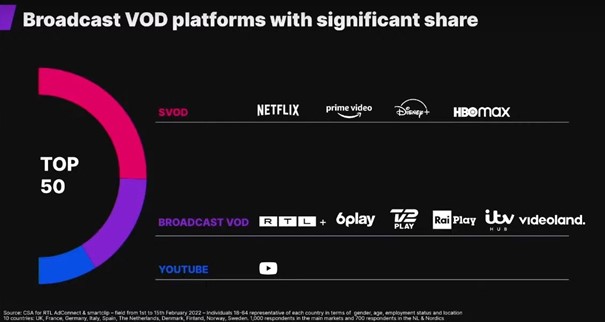

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”When we look at the most important video content players in the European market, we see multinational pay video operators Netflix, HBO, Amazon and Disney. YouTube has a significant presence, as well as non-paid VOD services from European broadcasters such as RTL+, ITV Hub, Rai Play, Denmark's TV 2 Play and others.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”These TV players are investing heavily in their VOD services and creating interesting solutions for advertisers in the form of one-stop shops where they offer different types of ads in one package. To this end, they are also demanding comprehensive technology platforms that enable scalable addressability of ads. This is exemplified by the collaboration between German broadcaster RTL and technology company smartclip. In addition to linear broadcasting, the RTL TV group offers various types of VOD services including BVOD, AVOD and SVOD, and advertisers can use personalised advertising on all these channels with the technological support of smartclip.

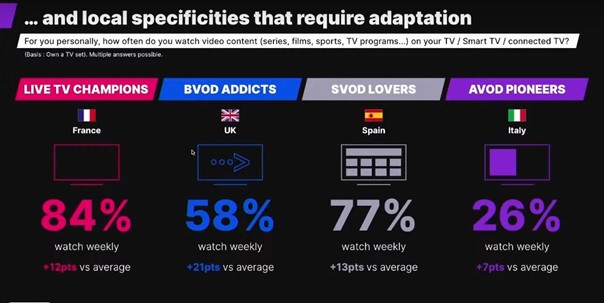

EACH COUNTRY HAS ITS OWN SPECIFICS

It is also important to take into account that the behaviour of content consumers varies from one European country to another. This may be of particular interest to large multinationals looking to advertise across Europe. In France, for example, a large number of viewers prefer linear, live broadcasting. In the UK, BVOD services are popular, with the ITV Hub platform being particularly popular. Spaniards, on the other hand, are big fans of pay video services.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”HOW TO MAKE ADVERTISING MORE INTERESTING AND RELEVANT

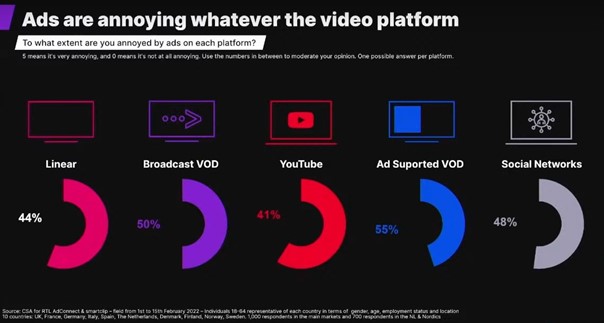

When we look at media consumption and the business model built on it, knowledge of how advertising works on different platforms and how viewers perceive it is valuable, especially for advertisers. It's important to remember that advertising will always be within the boundaries of being acceptable or even interesting to some viewers, but on the contrary, some viewers find it annoying. At the same time, viewers perceive the (un)tolerability of advertising on all video platforms in a similar way.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”Viewers cite the ad’s nuisance, frequent repetition and low relevance as the main negatives. A comprehensive use of data and technology should help to eliminate these negative impacts of advertising as much as possible.

Looking at the last five years, linear broadcasting and with it the size of screens has changed shape significantly. Internet connectivity, Smart TV, the use of multiple devices, and HbbTV have become increasingly common. Broadcasters are investing in new technologies and trying to bring new solutions and innovations.

Innovation in advertising is driven in particular by HbbTV technology and the advertising formats it offers. One of the options is the so-called L-Banner, which also fits into linear broadcasting and, according to Sebastian from RTL AdConnect, does not cause distractions while watching a show. The content you are watching stays on the screen and the L-shaped banner with the advertising message frames the programme. This format is already used by TV broadcasters in Germany, Spain, France, Austria and Italy.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”ON THE DIGITAL JOURNEY TO THE CONSUMER

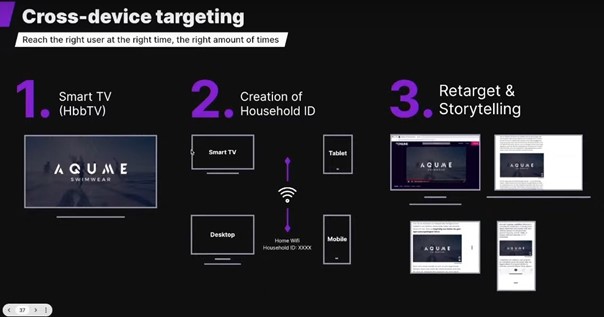

As mentioned, consumers use other devices in addition to the big screen in their living room -- small screens, especially mobile phones or tablets. Meanwhile, more than 80 percent of viewers tend to jump to another screen when an ad is running on the big one. The big screen thus becomes one of the touchpoints in a user's digital journey as they consume content. In this consumer attention journey, it is therefore important to connect the big screen with all other devices thanks to the possibilities that Smart TV (HbbTV) and cross-device targeting already offer today.

The aforementioned technologies make it possible to create a specific household ID that tracks all connected devices. The basic Smart TV ID is a non-transferable ID that pairs other devices used in the home. Advertisers can thus deploy a classic TV campaign and extend its reach with incremental reach (added value of online advertising). It is also advisable to tailor the content of the ad to all other devices (cross-device storytelling) and then use retargeting of the already viewed TV ad on other devices.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

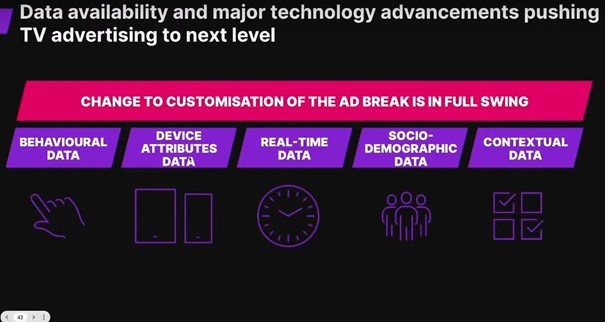

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”As mentioned earlier, users expect personalised, relevant advertising, which they are more receptive to than conventional advertising. The use of data and technology can take advertising to the next level and offer a tailored message to each viewer.

Thanks to the data collected through Smart TV, it is already possible to customize advertising messages. This includes behavioural data that maps viewer behaviour - what programme they watch, at what time and on what device. This is complemented by third-party and real-time data, such as stock market data, weather data, as well as socio-demographic data (first party data) -- for example, broadcaster data on subscribers (age, gender, location) or TV viewership data. All this is complemented by the use of contextual data - additional information about the context of the content being watched.

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”

Source: smartclip & RTL AdConnect; “The New Life of The Living Room”Thanks to the aforementioned advanced targeting, each household can see a different ad that matches the interests and habits of its members. This advanced ad targeting was launched last year by German broadcaster RTL and is also being launched in Spain this year.

Television advertising is thus entering a new era and will in the future be fully driven by digital technology. The big screen will still play a vital role, but there are many more ways to reach potential customers.

The full lecture can be viewed here.

smartclip - a European advertising technology and media sales company offering scalable addressable TV and online video advertising solutions to broadcasters and publishers across Europe. A subsidiary of Mediengruppe RTL Deutschland, smartclip is part of the RTL Group.

RTL AdConnect - RTL Group's international media agency dedicated to the sale of Total Video Advertising. With its media partners from within and outside the RTL Group, it reaches approximately 160 million potential consumers in Europe every day. It is an official partner of smartclip and also uses and offers its technology solutions.