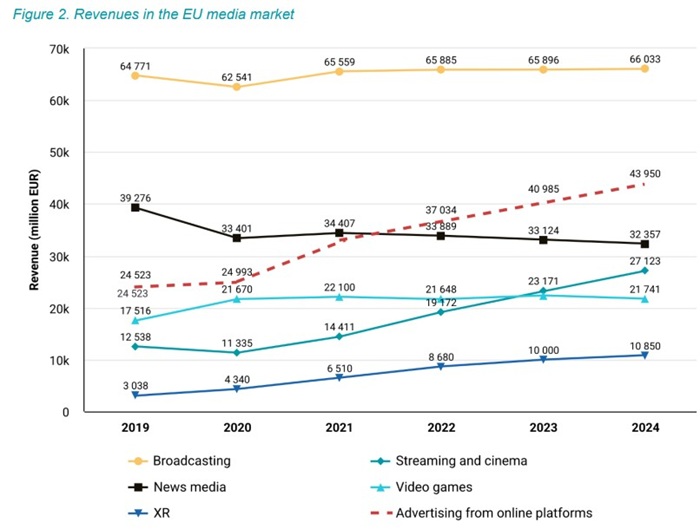

The European media sector has seen revenue growth in recent years, but declining profitability. According to the latest figures published in The European Media Industry Outlook 2025, it will generate around €158 billion in 2024, a six per cent increase on 2022. Streaming and the development of immersive technologies are the biggest contributors to growth, as is the growth in advertising from online platforms. Broadcasting remains the strongest. Traditional news media revenues are declining slightly, but on the other hand they are maintaining relatively stable margins(see charts below).

The market structure varies significantly by segment. The audiovisual sector is fragmented between national players, smaller producers and global platforms, with the top 100 companies in Europe growing twice as fast as the market as a whole. In contrast, the video games and augmented reality sector is dominated by a few multinationals (for example, Meta controls more than half of the European market for XR technologies).

A significant part of media companies' revenues are threatened by online platforms such as Google, Meta and YouTube, whose advertising revenues now exceed those of traditional news media. Although the European media market is replicating developments in the United States, it lags behind in terms of revenue volume, generating roughly half of the US volume, even though the EU has a 30 percent larger population.

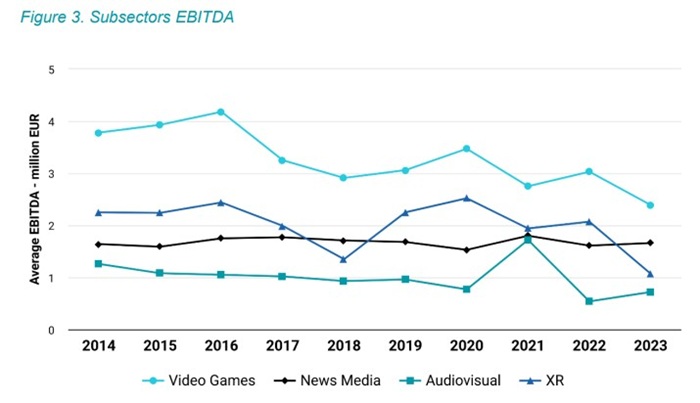

The profitability of the media sector has been declining over the last decade. According to EBITDA, average profitability has declined across most media sectors between 2014 and 2023. As a result, media companies' revenues and profits show considerable cyclicality and a strong dependence on technological innovation and changing consumer behaviour.

Revenue development in EU media markets (EUR million); Source: The European Media Industry Outlook 2025

Revenue development in EU media markets (EUR million); Source: The European Media Industry Outlook 2025 EBITDA growth (in millions of EUR) in media segments; Source: The European Media Industry Outlook 2025

EBITDA growth (in millions of EUR) in media segments; Source: The European Media Industry Outlook 2025Online video is already overtaking pay TV

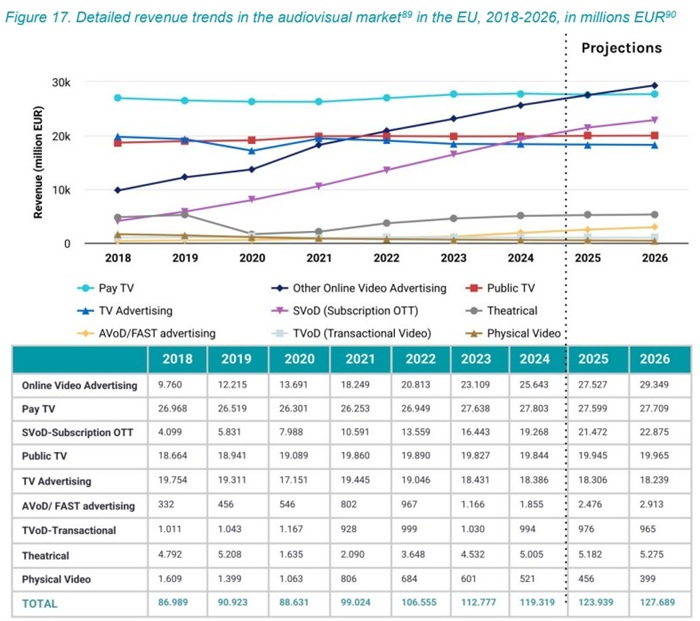

The audiovisual industry is the largest source of revenue and jobs in the European media. It has rapidly expanded to include VoD services, while traditional segments such as DVDs have virtually disappeared. The main sources of revenue remain pay TV, television advertising, and public funding, but their importance is gradually declining in favor of online platforms and streaming.

The share of broadcasters in revenues fell from 75% in 2018 to an expected 53% in 2025, while SVoD (subscription video revenues) is expected to grow to 17% by the same year. Cinema revenues have recovered after the pandemic, but have not yet reached pre-COVID levels.

Online video advertising has become the second-largest source of revenue and is expected to nearly double by 2029. Both streaming services and broadcasters are transitioning to hybrid models that combine advertising and subscriptions. Nevertheless, the market remains highly concentrated, with US companies increasing their share.

Source: Technopolis Group na základě dat Ampere Market Operators, The European Industry Media Outlook 2025

Source: Technopolis Group na základě dat Ampere Market Operators, The European Industry Media Outlook 2025Models with advertising are trending

Streaming services are increasingly combining subscription with advertising models. Netflix, Disney , HBO Max or Paramount have introduced lower-priced tariffs in exchange for watching ads, and Netflix has even doubled its advertising revenue in the last year. This approach makes it possible to reach more price-sensitive audiences. A similar strategy is being developed by European players, such as Spain's Atresmedia with its Atresplayer platform.

Connected TV is also growing rapidly in importance, reaching nearly 90 percent of consumers in mature markets by 2023. Advertisers here are testing new formats such as interactive advertising with QR codes or voice control. Hardware manufacturers are also entering the smart TV space: services such as Samsung TV Plus or LG Channels offer free ad-funded content.

The FAST (free ad-supported streaming television) segment, which provides viewers with freely available linear channels with advertising, is showing the most momentum. Its revenues are expected to grow by more than a fifth by 2029. Large providers such as Pluto TV, Rakuten TV and Roku Channel are already present in the EU.

Despite higher investment, European content remains behind US content in terms of viewership. On SVoD platforms, European works account for a fifth of catalogues but only 16% of viewership, while US titles take up two-thirds of the cinema market. The use of artificial intelligence is also growing rapidly, with 39% of European audiovisual companies using it in 2024, up from 21% a year earlier. The global market for generative AI in media is expected to reach €48 billion by 2028. However, skills shortages are holding back development in Europe, particularly in virtual production and post-production, where 80% of companies report difficulties in recruiting specialists.

The full report can be viewed here or in this material.

Source: mediaguru.cz