Quality of content, more accurate targeting and a safe advertising environment are key factors that play an increasing role in the decision to buy video advertising. One of the main recent trends is the growing interest in advertising on smart TV (CTV), where viewers skip ads less and pay more attention to them.

Media Club is responding to these changes not only by expanding its premium video inventory but also by introducing its own DMP platform that enables advanced targeting of registered users. In addition, Media Club is also dedicated to the development of HbbTV, bringing new opportunities for regional targeting and interactive formats.

In this interview, Petr Hatlapatka, Sales Director of Media Club’s online division, talks about how video ad buying strategies are changing and the impact of the growing popularity of CTV.

Premium video advertising is increasingly in demand today, not only because of the quality of the content but also because of brand safety. How do you reflect the new trends in video consumption, and how does your Premium Pack adapt to the changing needs of advertisers?

The Premium Pack has already been part of our offering, but we have made some significant changes. For the last two to three years, we have worked hard to expand our inventory, including representing other video services. We have started working with Canal+, and more recently, Sweet.tv has joined our portfolio. Our goal is to expand the reach of video advertising, and we also want to underpin the changes in video consumption, where linear viewership is shifting towards non-linear viewership, especially among younger audiences. At the same time, we aim to ensure that advertising is shown in an appropriate and safe context and on large screens with high-quality imagery. This is why we avoid user-generated content, for example. The Premium Pack reflects all of this.

Different formats have different benefits. How do your packs differ, and what determines which format clients choose?

When it comes to video advertising, we also offer the Add Up pack, which includes video placements across all the sites we represent within Media Club and Impression Media – including Prima’s content sites and video services. This pack has the highest reach. The Premium Pack is only focused on video advertising for long-form video, which is the format that clients find most attractive.

Add Up is more affordable, while the Premium Pack focuses on higher-quality content with higher viewer attention. Research and viewer behaviour show that people skip ads less on smart TVs and have higher completion rates. At the same time, they are guaranteed 100% viewability and brand safety. The most exclusive pack is the CTV pack, which is aimed exclusively at smart TVs. This pack contains long-form content on smart TVs. It is the most sought-after by clients because it delivers quality and, therefore, is also the most expensive. CPT is twice as high for CTV as for traditional content, yet it is in demand and has been one of the fastest-growing over the past year.

In general, however, we are seeing total video reach - it doesn’t matter whether the viewer is watching linear or catch-up TV on Prima+ two days later. What matters is that they consume our video content.

CPT is twice as high for CTV as for traditional content, yet it is in demand and has been one of the fastest-growing over the past year.

Petr Hatlapatka

You have already mentioned that the viewing of TV content or video content is moving from linear broadcast to non-linear platforms. Do you see an opportunity for advertisers in this trend? What are the main advantages of advertising on smart TV versus other channels?

We see that premium advertising is now increasingly sought after by clients, especially due to the targeting options. For example, our new partner, Sweet.tv, shows 70% of impressions on smart TVs. This type of advertising is not skipped; viewers are spending more time on it, and this matches the needs of clients. Advertisers also take into account that smart TVs are shared devices and more viewers are sitting in front of the screens, so one impression reaches more viewers.

How much of your total video portfolio is made up of CTV advertising?

A rough estimate is about a third of the Premium Pack. The Premium Pack alone makes up about 70-75% of the impressions in the overall portfolio, with the rest coming from formats across all sites.

CTV’s advertising rates are the highest in the video advertising price list. How do they change over time?

CTV shows the largest year-on-year price increase, with the average net CPT price in programmatic sales exceeding EUR 10 in our region. In Western Europe, it is above EUR 15, and our prices are starting to approach these levels.

You describe that you are trying to expand your inventory both through your own services and by integrating external services. What impact is this having on Media Club’s overall video inventory?

Last year, we generated 24% more impressions as a result of this compared to the previous year, which is a significant increase. The biggest growth we saw was in smart TV apps, where inventory grew by 83%. In addition, content magazines, such as CNN Prima NEWS, also increased by 60%, and IPTV operators grew significantly as well, with an increase of up to 85%. These leapfrog changes are the result of the gradual addition of more operators.

We anticipate that the number of IPTV operators where we will be able to include video advertising will expand again this year. We are currently working with five operators. We see that 60% to 70% of IPTV impressions are happening on smart TVs.

And how did that reflect in video ad sales overall last year? How much did the market grow?

We sell about 1.2 billion impressions a year, and we are growing 10-20% in impressions sold.

Last year, we created 24% more impressions compared to the previous year, which is a significant increase. Our biggest growth was in smart TV apps, where inventory grew by 83%.

Petr Hatlapatka

Online GRP, called eGRP, has been part of Media Club’s TV advertising and video advertising sales for a long time. Will the broader video inventory increase its overall share of campaigns sold?

In the first few months of this year, eGRP makes up about 20-25% of total online inventory, which is a significant increase from previous years. The winter season contributes to higher consumption as people spend more time at home. Year-round, we expect to stabilise at 10-15%.

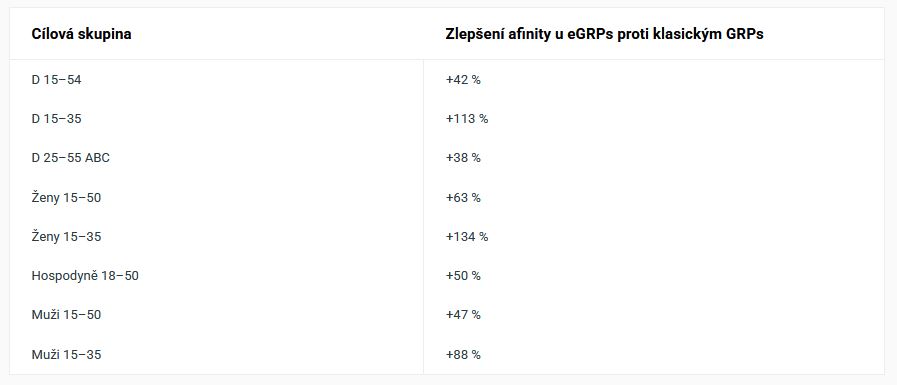

However, it is interesting to look at the affinity of eGRP and traditional GRP. It shows that the younger target group of 15-35 years old shows an improvement in affinity of up to 134%. The younger the target group, the better the affinity for eGRP. But this is also true for the broader 15-50 age group, where there is still a 56% affinity improvement for online. This trend proves that eGRP is particularly effective for younger audiences. As inventory grows, this quality will continue to improve.

Comparison of conventional GRPs and eGRPs for 2024

Source: Media Club. Note: This is a comparison of actual GRPs and eGRPs delivered.

Source: Media Club. Note: This is a comparison of actual GRPs and eGRPs delivered.Last autumn, you announced that you would launch your own DMP in the first quarter of this year. It is designed to enable clients to take advantage of targeting registered users of so-called 1st and 3rd party data in both direct and programmatic buying. Until now, these targeting options have been limited to the advertising system. Have you launched DMP yet?

Yes, we have already implemented our DMP and consider it a significant step forward compared to previous external solutions. It is linked to CPEX, and we have comprehensive data from the entire market. Data-wise, we have moved on significantly and can target not only classic banner formats but also video advertising with even greater accuracy and efficiency. We can also better analyse audience behaviour and tailor advertising messages to specific target groups. The data is then processed in the advanced Adpicker tool, which uses machine learning to create sophisticated user segmentation.

How exactly does audience targeting and segmentation work?

Although we are limited in some areas by our move away from third-party cookies, we do have access to TV broadcast data. Based on socio-demographic data from ATO-Nielsen measurements, we are able to shift targeted content from TV to online platforms. For example, when women watch specific shows on TV, we can use this data to predict the online user. This is also aided by our ability to target eGRP campaigns precisely to the desired target group. While campaign booking is targeted at the 18-69 group, clients also specify their primary target group when booking. This data then feeds into the DMP, and the system calculates how many GRPs to deliver and therefore tailor to the preferred target group.

Based on socio-demographic data from ATO-Nielsen measurements, we are able to shift targeted content from TV to online platforms.

Petr Hatlapatka

CTV is one of the most talked-about trends of our time, which we have already mentioned. HbbTV, which has represented CTV advertising so far, seems to be in its shadow.

It’s more accurate to say that HbbTV is already included in the CTV landscape. And it is not the case that development has stopped in HbbTV. On the contrary. Display advertising in HbbTV can be targeted to selected segments, and defined target groups can be reached on Prima channels using the red button. Historically, we have only used targeting on channels, times, selected shows or perhaps the client’s TV spots. The data we have on TV channels, particularly data on what individual devices watch, at what times and so on, combined with our knowledge of the sociodemographics of our TV channels, allows us to model audiences that replicate the sales target groups known from TV buying.

We also see that over the last year, clients have started to make more use of non-standard formats in HbbTV, such as multi-button, which can be used for polls and contests, and switch-in strip.

Over the last year, the traffic structure of the Prima Nákupy app has also changed dramatically, with 80% of the traffic now being organic. Viewers have learned to use the flyers and discount coupons on TV, and I consider last year a milestone in this respect. We knew the turnaround would happen. That’s why we have prepared for this in the past and have continuously worked on the product and the Prima Nákupy brand. Now we will intensify these efforts.

What are you preparing?

For AdSimple.cz, the automated HbbTV buying platform, we will launch an updated version in March, which will be enriched with campaign targeting functionality for all 76 districts. Until now, it was only possible to target regions. The targeting of districts resulted from market feedback, especially from local agencies and smaller clients. With district targeting, we will go deeper into the regions.

Source: mediaguru.cz