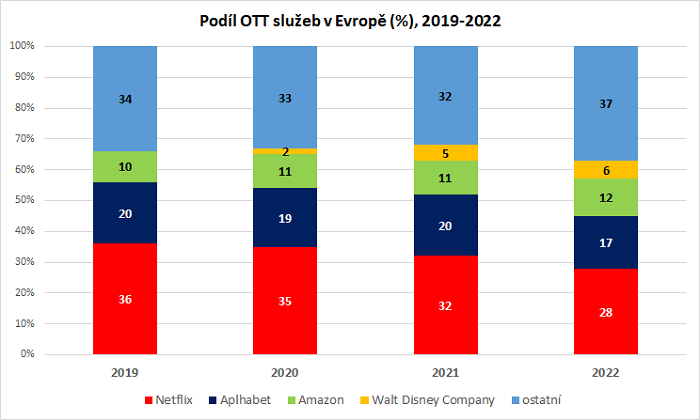

Netflix and Alphabet, which also operates the YouTube video platform, continue to have the highest share of the European OTT (over the top) market, but their combined share has declined by less than ten percentage points over the past five years to 45% (as of the end of 2022). This is according to Dataxis data presented at the international Nextv conference held in Prague last week. This is due to the arrival of new multinational players but also local services. The five-year trend shows that Walt Disney, operator of Disney+, is growing its share of the European market, while Amazon's share has also increased slightly, as well as that of other services.

Source: Dataxis

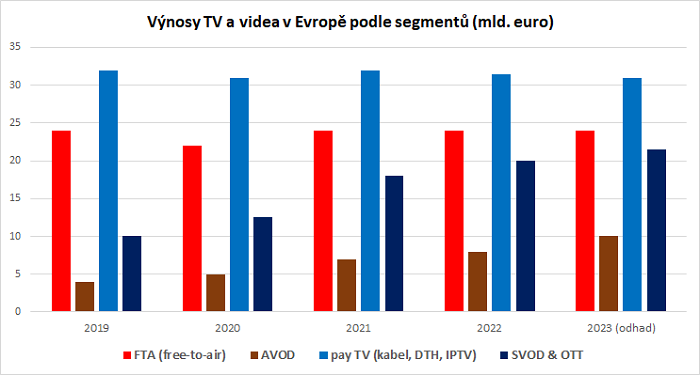

Source: DataxisThe trend overall is continued growth in OTT platform revenues in Europe. The most significant growth was recorded between 2020 and 2021 (+37%), while last year growth slowed to 16% year-on-year. Pay video on demand (SVOD) services account for the largest share of OTT revenues, followed by ad-supported VOD (AVOD) and OTT pay TV. The number of OTT platforms is still increasing, although last year's 1.9% year-on-year growth opens up room for consideration as to whether the market is approaching saturation.

While local content is important for individual markets, experience in various European markets shows that global content also has the power to attract audience interest. Often, it also results in local adaptations that are popular with audiences, among other points made in the debate. Mystery and crime stories based on real facts are still a big draw. Companion formats to successful titles are also gaining popularity, offering viewers additional details on the main characters or details on the stories (spin-offs, behind the scenes, etc.). However, a slightly different mix may work in each market. "If a format is successful in multiple markets, it is likely to be successful here too, reducing our production risk. For example, foreign adaptations work well in Slovakia, while the Czech market prefers local content," pointed out Silvia Majeská, programme director of TV Nova and TV Markíza, who also represented the local Voyo service, in the debate.

TV and video revenues are growing in Europe

The European TV and video market generates a total of €90 billion annually and has been growing at an average of 25 % over the last five years. Pay TV channels (cable, DTH, IPTV) and free-to-air channels generate the largest share of revenues. However, over the last five years, the most significant revenue growth has come from the digital segments - SVOD and OTT, which are forecast to approach the total free-to-air volume by 2023.

Source: DataxisIn SVOD, Netflix remains the strongest platform in Europe, with more than 60 million European subscribers (end-2022 data). This is followed by Amazon Prime Video with more than 40 million subscribers, Disney+ (20+ million), HBO Max and RTL+ rounds out the top five. The top ten SVOD platforms account for 78 % of the European market share, with other SVOD services accounting for the rest.

The northern part of the European continent is more dependent on revenues from subscribers, while the Mediterranean European countries, as well as Central and Eastern European countries, rely more on TV advertising revenues.

In terms of TV advertising revenues, RTL is the strongest in Europe ahead of MediaForEurope, ProSiebenSat.1, ITV and TF 1. The Central European group CME, which includes TV Nova, is the 13th strongest in the European market in terms of TV advertising revenues (data refer to 2022).

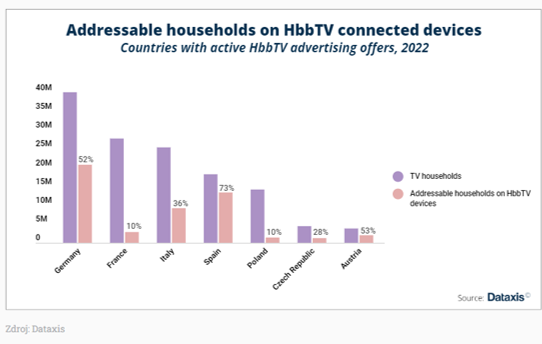

The data also shows that the number of smart TVs in European households is gradually increasing, as is the number of connected TVs (CTVs), which have increased in prevalence by an average of 7 % over the past year. However, there are differences between countries.

The experience of European broadcasters is that viewing time on CTVs is also increasing. Italy's Rai has even registered an 85 % year-on-year increase in time spent on connected screens, and the time spent watching each episode is growing as well, the discussion went on. But viewers are also watching live TV on apps, which is becoming more connected to on-demand content. With the growing attention of internet-connected devices, TV advertisers are becoming more interested in digital TV options - more than 80 % of Rai stations' clients also advertise digitally.

Targeted commercial outreach is happening primarily through the HbbTV standard. So-called addressable advertising, which was expected to account for 13 % of total TV advertising investment by the end of 2022, was possible in 17 European countries. It is most heavily used in the UK, Germany and then France. However, the Czech market is relatively strong for HbbTV and therefore for addressable TV advertising opportunities, given the total number of TV households. According to Dataxis, the share of Czech HbbTV households in the total number of TV households is almost 30 %, making it the fourth largest in Europe.

Source: Dataxis

Source: Dataxis

Source: mediaguru.cz